BurgerFi: Good Q1 Report, Too Many Extenuating Factors

![]()

BurgerFi: Good Q1 Report, Too Many Extenuating Factors

May 30, 2022 5:01 AM ETBurgerFi International, Inc. (BFI)1 Comment1 Like

119 FollowersFollow

Summary

- BurgerFi reported exceptional revenue growth in Q1 2022. With 15-20 new locations this year, it’s holding strong to its expectation of $180 million in revenues.

- Despite the positive trend, much of the revenue growth is coming from its acquisition of Anthony’s Coal Fired Pizzas.

- Divulging into each expectation for 2022 and beyond reveals that the shares are currently undervalued.

- There are too many extenuating factors like inflation and supply chain outside of BurgerFi’s control to have a high level of safety with initiating a position into the stock at this time.

I recently wrote an article about BurgerFi’s (NASDAQ:BFI) business model, strategy, and financial 2021 performance. I concluded that fiscal 2022 would be a difficult year due to supply chain shortages and logistical nightmares despite strong performance. Because of these issues, it wasn’t worth investing in at that time. You can read about that by clicking here.

The company recently announced their Q1 2022 performance. In this article, we will talk about those results and assess where BurgerFi is headed in the future. We will finish off with a valuation and see whether the stock is fairly or over/undervalued at its current stock levels.

Q1 2022 Performance

Revenues

For the three months ended March 31, 2022, BurgerFi reported $40.4 million in revenue. This is 300% growth over the same period last year. Of the $40.4 million reported, $9.9 million was the result of corporate-owned restaurants, and $30.9 million the result of sales from both its subsidiary, Anthony’s Coal Fired Pizza and its franchisees. It is important here to note that while franchised revenues were the bulk of total revenues, same-store sales actually decreased 5% when compared to Q1 last year. On the other hand, corporate restaurants’ same-store sales decreased by more than 5%, but experienced higher sales growth overall with a 20% increase this quarter.

Wake up with Wall Street Breakfast

Get your daily take on the financial markets with Seeking Alpha’s flagship newsletter.Get for freeI agree to Terms of Use & Privacy Policy.

I am a bit perplexed by this result. 300% revenue growth is great. However, same-store sales for both corporate and franchised restaurants are actually decreasing. This signals that BurgerFi is buying growth rather than driving its restaurants organically.

BurgerFi’s second brand, Anthony’s Coal Fired Pizza, experienced same-store sales growth of 13% this quarter. This matter of purchased growth is especially troubling when one considers why BurgerFi acquired ACFP in the first place. According to management, the $156 million purchase was done with the intention to bolster synergies between the two brands and reduce costs. While you will see the long-term planned benefit of the synergies below, it is seeming to have provided an unintended effect on the top line currently.

EBITDA

In terms of operating improvements, adjusted EBITDA grew 200% this quarter from $0.7 million to $2.3 million. This was the direct result of the purchasing power created when the two brands joined, the leadership cohesion, and the addressable market size. The company expects to garner $2 million a year in cost savings from the acquisition and is on track for that this year.

However, to achieve sustainable EBITDA growth in the brand, the company must have its restaurant-level operating expenses in line. These expenses are always managed in food and labor costs.

Food and Labor Costs

For the BurgerFi brand alone, food cost for this quarter totaled 30.8%, which is 2.2% higher than Q1 2021. Labor cost totaled 28% or a 2.8% increase over its previous year.

For the consolidated account, food cost totaled 29%, which is 1.2% higher than Q1 2021. Labor cost increased here by 3.5% to 29.7%.

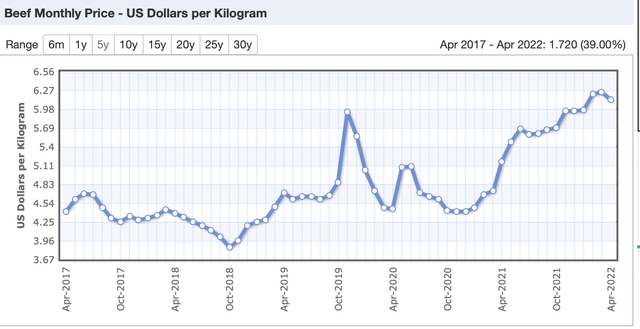

The increases in food cost, while less than labor, are the direct result of global food shortages and their resulting price increases. According to Index Mundi, one kilogram of beef cost $5.60 a year ago. Today, one kilogram is $6.31. I expect these numbers to continue rising as input costs like grain and fuel become both more scarce and expensive. Other commodities like potatoes have also been rising and it will continue to affect overall food cost.

On another note, inflation has been spiraling out of control and many expect that to have lasting effects on the cost of living. In times of high inflation, salaries are usually the last to increase. With this, I expect there to be a rise in the minimum wage soon. Unfortunately, a timeframe is unrealistic, but any prudent business should expect rising salaries in the near future.

Revisiting 2022 Guidance

In its Q1 report, BurgerFi stated it is sticking to its 2022 guidance. However, the stock price has dropped roughly 18% from when I last wrote about it. Therefore, it’s worth looking into a valuation here.

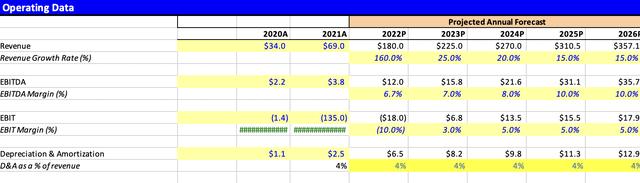

Below is the 2022 guidance:

1) Annual revenues in the range of $180-$190 million

2) mid/single-digit same-store sales growth

3)15-20 new franchised locations

4) Adjusted EBITDA of $12-$14 million

5) CAPEX of $4 million

In terms of the revenue guidance, this quarter’s $40 million result puts BurgerFi somewhere on track to meet their revenue goal. April to August are typically the busiest months for the restaurant industry as a whole. Therefore, if it can outperform during these months, I don’t see why BurgerFi won’t make the $180 million revenue goal. Even if BurgerFi does fall short of higher revenues during these busy months, it’s not game over for the optimistic goal. With roughly another 14 locations expected to open this year, BurgerFi should be able to apply some momentum to this push.

With regards to the CAPEX expectation, I will refer to the 2021 CAPEX spend to analyze this year’s assumption. In 2021, CAPEX was $10 million and 10 new stores opened. Of the 10 new stores, 4 were corporate-owned. If we exclude all other capital costs, then capital cost per store was $1 million. However, BurgerFi’s franchising model allows it to expend less capital to grow its company. With roughly 15-20 new stores, the expectation that BurgerFi will blow through the $4 million CAPEX expectation to build out new stores is far-fetched since most of the stores are being franchised. Nevertheless, if this were in fact true, then $4 million is well within its reach for 2022 buildouts.

The final point to address is the adjusted EBITDA of $12-$14 million. The $3.8 million in adjusted EBITDA for 2021 was offset by a large $100 million non-cash impairment charge on the balance sheet. After normalizing this charge, expenses were roughly $75 million for the year-end. With cost savings of roughly $2 million a year from the acquisition of ACFP, BurgerFi should have no trouble reaching this goal. Remember, with $180 million in revenues expected, $12 million in adjusted EBITDA is only a 6%-7% margin. Last year, it was 5%.

Valuation

With all this said, let’s take a look at the valuation.

Let’s start with revenues. In my assumptions, I followed management’s expectation of revenues for 2022 but quickly dropped revenue growth downwards to 25%. I will refer to a claim in my last article to support this point. That claim alluded to the idea that BurgerFi had no real competitive advantage. Unfortunately, hormone-free burgers and free WiFi are not unique selling propositions. In a highly saturated, competitive landscape like the burger market, competition erodes growth.

Now, I’m not saying it’s doomsday for BurgerFi. It does have something unique: its place in niche markets. BurgerFi is highly situated around parts of the south, like Florida. Here, it’s actually recognizing a lot of its growth. Therefore, building a brand that consumers in these areas are accustomed to can open it up to a Shake Shack (SHAK)-like story of growth. That’s why I kept revenue growth above industry average for the next 5 years.

Through the rest of the valuation, I grew EBITDA upwards to 10% to reflect the continued synergies from BurgerFi and ACFP as it leads to operational improvements across the company. I further assume that BurgerFi would reach a profitable state by 2023 as it scales down expenses like corporate overheads and marketing by utilizing its digital channels like its app and website for advertising. Remember, restaurants really have two main costs: labor and food. BurgerFi is performing well in this regard, keeping below the 60% recommendation. Therefore, refocusing on growing its franchised business should improve BurgerFi’s margins.

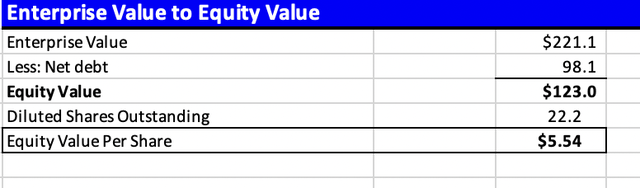

All in all, I ended with an enterprise value of $223 million and an equity value per share of $5.54.

Risks

BurgerFi’s share price as of writing is $3.15, which represents a 78% upside from its fair value. As always, my assumptions can be completely wrong. After all, there are substantial risks. For one, beef prices and other products used in the making of burgers are historically high. In addition, there are massive global logistic and supply chain shortages. This can lead to both substantial price increases for BurgerFi and worse, no products to sell. BurgerFi has softly indicated they are facing supply chain challenges in their Q1 report but has not indicated exactly what those challenges are. However, looking at the entire industry reveals that they are likely facing some of these problems.

For one, an article by Market Realist has indicated that a leading cause for the current shortage of beef is lower yield per animal. According to the report, a leading grocery chain called Moody’s Quality Meats indicated that beef being sold has less meat because slaughterhouses are holding cattle for shorter durations of time due to rising demand. Another input into the final product that BurgerFi serves is potatoes. Unfortunately, an article by Argos Blogs indicates that drought, rain, and spoiled potatoes have resulted in a global shortage of the product. In addition, poor supply management that was exposed by COVID-19 lockdowns has also aggravated this shortage.

Luckily, the entire industry is facing shortages. But where can the company go when it can’t fulfill orders? A brand like McDonald’s or Shake Shack has 100x the purchasing power of BurgerFi and will get first pick from suppliers. A real problem of getting beef or potatoes can arise if supply dampens due to another lockdown from COVID-19 or the relatively new Monkeypox virus.